Corrections in the Stock Market

Correction

/kəˈrɛkʃ(ə)n/

noun

1. the action or process of correcting something.

2. Used to introduce an amended version of something one has just said.

Here I’m referring to a stock market correction. After the enormous rally in almost all months of 2021. The party came to an end by a sudden fall in the markets. The born of a new variant in South Africa shocked the world and rattled the financial word with uncertainty and pessimism. United States inflation at a 39-year high. Major news which might led to uncertainty fled through news which created havoc among traders and investors.

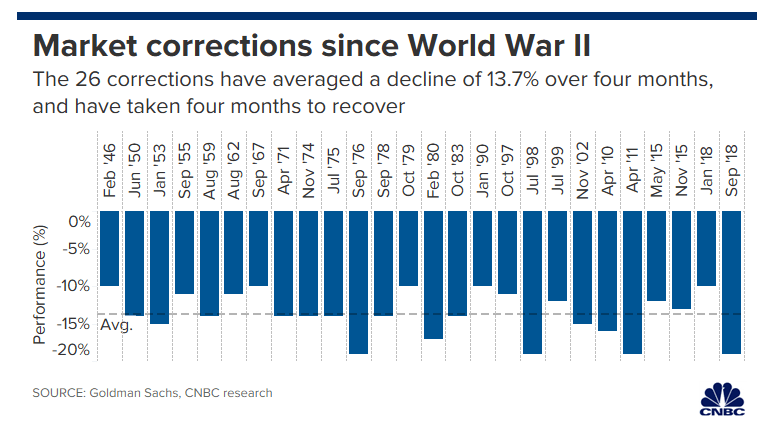

The broader market index for India Nifty50 rallied from 15,000 to 18,600 with certain small pull backs. While it is always said that corrections are always steeper on graph and sudden in time. Everyone knew that a correction was inevitable, It was going to come and create panic but a very few were able to time the correction. Here’s a research by Goldman Sachs which show the corrections and the number of months it took to recover.

Foreign Institutional Investors (FII) were on a continuous selling spree. Domestic Institutional Investors were on a buying spree. There was one more set of participants in the market - The new lads (Retail Investors). For the FII’s and DII’s correction was a discount at the mall while the new age investors who had never seen such a steep correction were really stunned by the fall because of tender their experience was.

Corrections have a nature of creating panic which makes it looks like this is the end of the world but the steeper the corrections, faster will be the bounce back. Staying Invested is an art. Seeing such wild swings in the world of Finance and staying calm needs a nerve of steel. Great Wealth can be compounded by doing nothing. Stock Market is 10% Buying, 10% Selling and 80% doing nothing.

The whole point of publishing this article is to educate everyone that temporary pull backs and corrections are common in the Stock Market. Corrections and Consolidations are good from the long term perspective of the market. The bulls will come back and take charge but you (Yes you impatient) gotta keep your calm

Compounding Wealth is important then earning wealth. All pessimism is permanent. Stay Invested.